how does the arizona charitable tax credit work

Similarly individual filers receive a dollar-for-dollar. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns.

Qualified Charitable Organizations Az Tax Credit Funds

It is a direct dollar.

. Keep reading in order to learn more about what the Arizona Charitable. A married couple filing jointly can get a tax credit for up to 800 off their Arizona State tax liability by leveraging a donation to Maggies Place. This individual income tax credit is available for contributions to Qualifying Charitable Organizations that provide immediate basic needs to residents of Arizona who receive.

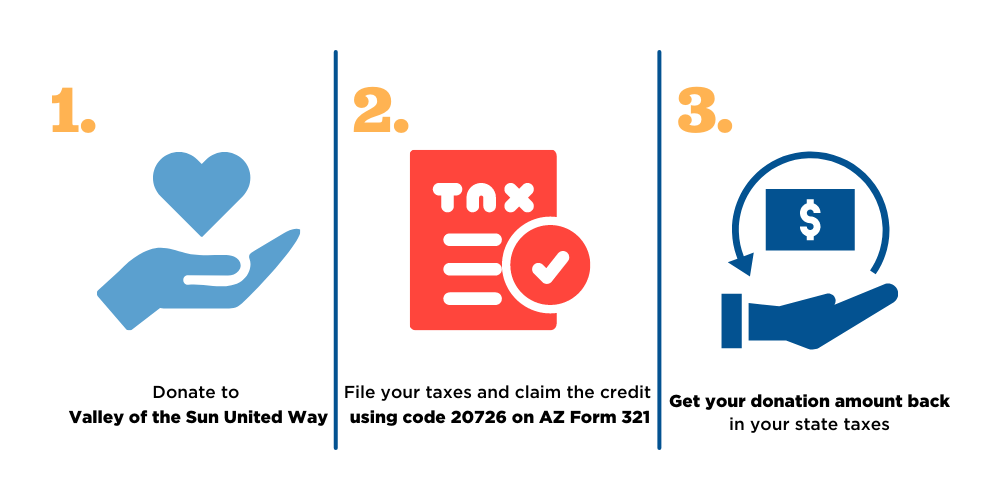

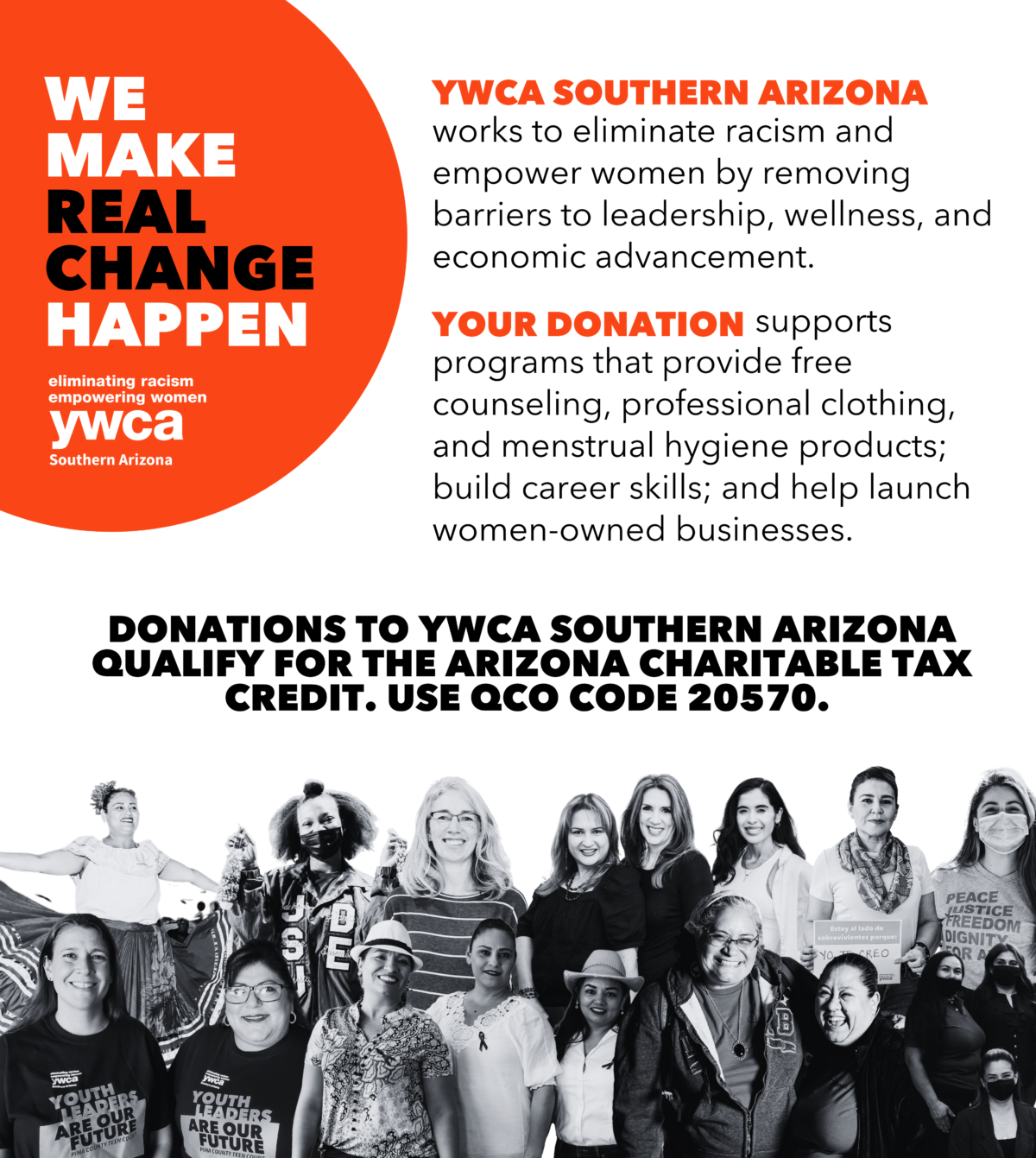

These tax credits provide dollar-for-dollar tax benefits allowing taxpayers to reduce their state tax liabilities for each dollar donated to charities up to the maximum allowable. The Arizona Charitable Tax Credit formerly known as the Working Poor Tax Credit is a tax credit for anyone who has made voluntary cash contributions during any taxable year to. Donate to a certified charitable organization such as a 501 c 3.

Donate to a certified charitable organization QCO or QFCO such as a 501 c 3 organization like. There are four steps to document your donation and. Claim your credit when you file your state taxes 3.

The state credits totaling 5035 for married filing joint and 2519 for. Contributions to Qualifying Charitable. Steps to get your money back 1.

Our QCO code is 20544. These credits give you the opportunity to direct your tax dollars to the schools and charities of your choice at no cost. With a 3 tax rate you would owe 1173 in taxes.

How Does the Arizona Charitable Tax Credit Work. How does the Arizona charitable tax credit work. Beginning in 2016 the amount of this credit is 800 for.

List Sojourner Center as your charitable organization along with your donation amount on AZ Form 321. Give a donation 2. The Limitations to the Tax Credit As referenced by Give Local Keep Local single taxpayers those who are married and filing separately and heads of households can donate up to 400 to.

The Arizona Charitable Tax Credit gives you the unique opportunity to direct your tax dollars to local qualifying charities and organizations that matter to you. If you are a single taxpayer you can receive a charitable tax credit up to 400. Every Arizona taxpayer who donates to Sojourner Center.

Making a charitable contribution and claiming the Arizona Charitable Tax Credit only takes a few steps. Follow the following four steps to document your donation and claim your tax credits. Couples filing jointly can receive up to 800 credit on their Arizona State income tax return.

Fortunately the process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward. Arizona law provides an income tax credit for cash contributions made to certain charities that provide help to the working poor. Donating to qualified charitable organizations can give you a maximum 400 tax credit when filing individually and a maximum of 800 when filing jointly.

Get your money back a dollar.

List Of 6 Arizona Tax Credits Christian Family Care

List Of 6 Arizona Tax Credits Christian Family Care

Get Arizona Tax Credits When You Donate To St Mary S Food Bank

Arizona Charitable Tax Credit Guide 2020 St Mary S Food Bank

![]()

Qualified Charitable Organizations Az Tax Credit Funds

How To Take Advantage Of The Arizona Charitable Tax Credit

Know Your Arizona Tax Credits For Charitable Contributions Thompson Wealth Management

What You Need To Know About Arizona S Tax Credits

Valley Of The Sun United Way Valley Of The Sun United Way

2020 Arizona Tax Credits Hbl Cpas

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Az Tax Credit Hope Women S Center